In the past two months, Indian market wiped out gains it made in the year 2018. Benchmark indices, Sensex and Nifty50, are down about nearly 17 percent from their respective highs which suggest that even quality stocks are now available at attractive valuations.

Just ahead of Diwali, more than 50 percent of the stocks in the S&P BSE Sensex and Nifty50 are down over 20 percent which suggests that bears have taken control, or bear phase has begun in these stocks.

“This is a Diwali sale, investors should buy good stocks. I would buy IndusInd Bank at current levels. The management of IndusInd Bank is high in quality,” Dipen Sheth of HDFC Securities said in an interview with CNBC-TV18.

“We are optimistic on NBFCs like Mahindra Finance and Chola Finance. RBL Bank is a long-term investment and it is possible to see 30-35% growth rates over the medium-term,” he said.

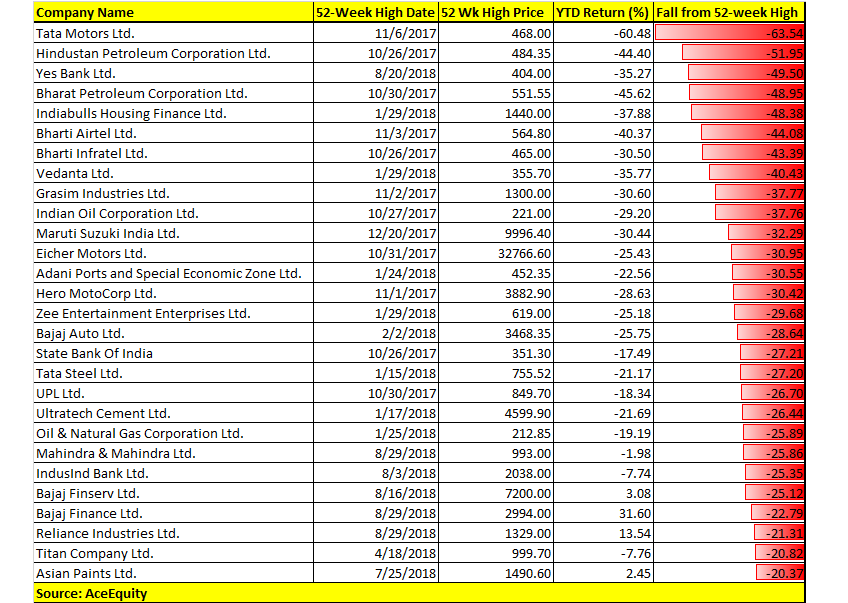

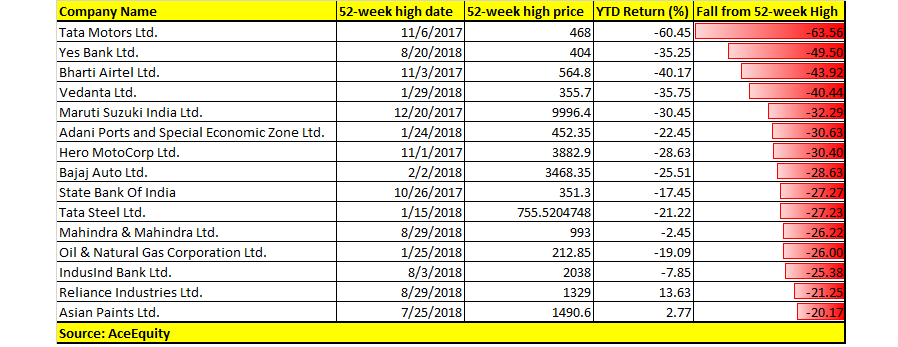

As many as 15 out of 30 stocks in the S&P BSE Sensex are down 20-60 percent from their respective record highs which includes Tata Motors, Yes Bank, Vedanta, State Bank of India, Tata Steel, IndusInd Bank, Asian Paints, Hero MotoCorp.

Many experts feel that for stocks which have fallen over 20 percent can’t be said to be in a bear phase because what we are witnessing it is more of event-based correction.

The Indian equity market remained in uptrend during the last 4 years with seasonal corrections of 5-6 percent on event basis but managed to resume the rally.

As the price was running ahead of earning by about 15x-20x, especially in small and mid-cap companies at the end of FY18, it was prudent to see the correction on account of muted earnings growth which is happening currently on board level, suggest experts.

“The current correction doesn’t augur completely a bear phase on broad-level but it is more of event-based correction which is not in favour of market coupled with overhung valuation concerns that peaked in the recent period,” Dinesh Rohira, Founder & CEO, 5nance.com told Moneycontrol.

“We have seen few quality large-cap companies correcting more than 20% due to slipover effect despite a strong fundamental. Although select-stocks may have entered the bear phase which doesn’t promise the future earnings growth, but overall market is only witnessing an event based correction that have a slipover effect on stock level,” he said.

Corrections in the price are more fierce in small & midcaps as compared to benchmark stocks. This creates a buying opportunity in quality management and business. However, every stock which plunged in double-digits does not qualify as a quality buy, suggest experts.

Among the Nifty50 names, over 50 percent or 28 out of 50 stocks have plunged 20-60 percent which include HPCL, BPCL, Indiabulls Housing Finance, Bharti Infratel, Vedanta, IOC, Adani Ports, Bajaj Auto and UPL.

“Corrections in the price in the recent times have been sharper or close to 20-25%, this creates a buying opportunity in quality management and business. Every falling knife is not bound to cut your hands,” Ritesh Ashar CSO KIFS TradeCapital told Moneycontrol.

“In recent times, the correction was due to global sentiments and overvaluations in some of the stocks. For example stock like Bharat Forge is moving in a secular uptrend and due to recent correction in the market the stock has corrected from the level of 693 to 541 but that doesn’t mean that the stock is in the downtrend. At this point of time one must look for stocks which are in a secular uptrend and can give better returns when the market turns around,” he said.